Featured News

Guides

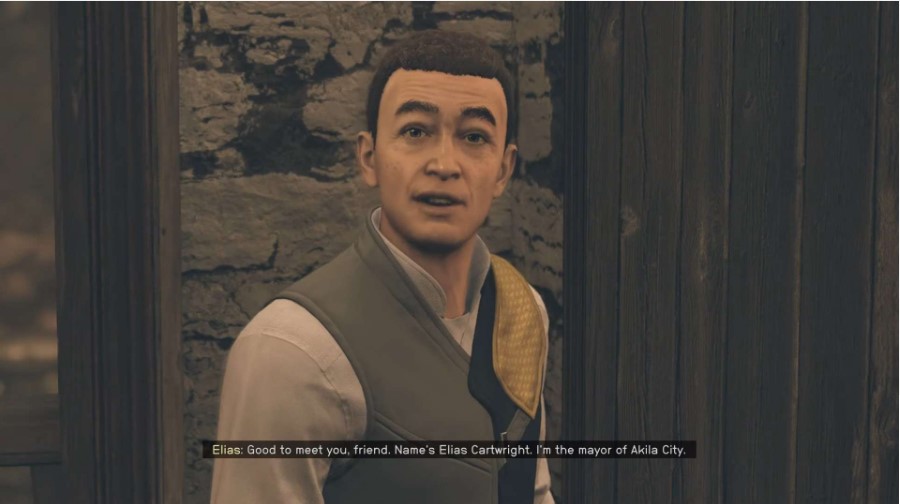

Starfield

Codes

-

291Roblox Codes

291Roblox CodesUntitled Boxing Game Codes for September 2023 – Free Spins and Money

Do you need codes for Roblox game Untitled Boxing Game ? We have the latest and most...

-

350Roblox Codes

350Roblox CodesKick Door Simulator codes for September 2023 – free spins, potions and keys

Welcome to the exciting world of Kick Door Simulator ! Created by Handsim Studios , this game will test...

-

320Roblox Codes

320Roblox CodesFabled Legacy Codes for September 2023 – Free Eggs and Diamonds

In Fabled Legacy, players battle through dungeons either alone against strangers or with friends, progressing through...

-

271Roblox Codes

271Roblox CodesRoblox Greenville Codes for September 2023 – Free Rewards

The latest, effective and functional codes that can be used to get a number...

-

328Roblox Codes

328Roblox CodesRo Fruits 2 codes for September 2023 – free bonuses

Roblox’s popularity is largely due to Roblox’s extensive library of games, which includes the...

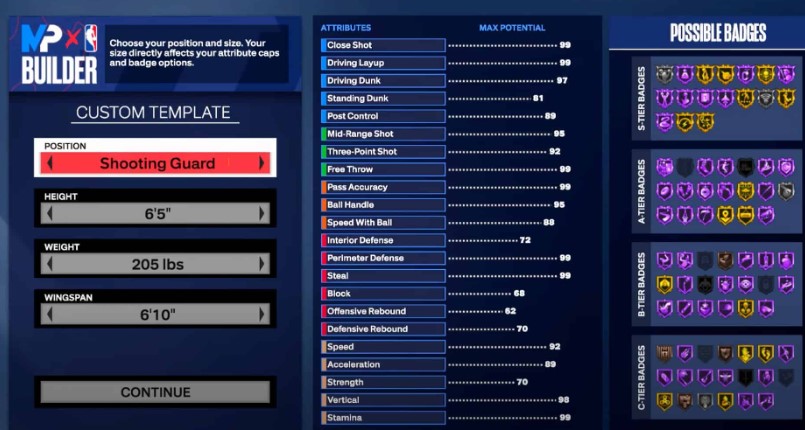

NBA

Roblox

-

179Guides

179GuidesShould You Side With Stone Lord Or Nine Fingers Thieves Guild In Baldur’s Gate 3

Should You Side With Stone Lord Or Nine Fingers Thieves Guild In Baldur’s Gate 3? It’s not an easy decision to make....

-

170Guides

170GuidesHow To Get Rid Of Enemy Of Justice Condition In Baldur’s Gate 3

Enemy Of Justice Condition In Baldur’s Gate 3 labels you as a murderer and sets all your victim’s allied guards against you,...

-

164Guides

164GuidesHow To Play Baldur’s Gate 3 Multiplayer Co-op

How To Play Baldur’s Gate 3 Multiplayer Co-op gameplay and go on adventures with your friends. Setting up multiplayer in Baldur’s Gate...

-

170Elden Ring

170Elden RingElden Ring, Temple of Eiglay

Are you crazy about playing the Elden ring and don’t know properly about what the Elden ring, Temple of Eiglay, is? Then...

-

169News

169NewsMona Singh opens out on Instagram twice in 2023, owing to photographs she took with Aryan Khan and Shah Rukh Khan.

Mona Singh experienced a truly remarkable year, leaving an indelible mark on both OTT platforms and Instagram. Notably, she garnered significant attention...

-

239Film

239FilmAnimal, starring Bobby Deol and Ranbir Kapoor, is currently the fourth-highest grossing Indian movie in North America and is headed for $15 million.

The action-packed cinematic masterpiece, “Animal,” helmed by the visionary Sandeep Reddy Vanga, has triumphed in its quest for greatness. With the charismatic...

-

188News

188NewsAfter the success of Dunki, Shah Rukh Khan meets fans outside Mannat with folded hands. Observe

Shah Rukh Khan graciously graced the vicinity of his opulent Mumbai abode, Mannat, in a seldom-seen spectacle, as he humbly acknowledged and...

-

182News

182NewsDay 3 global box office receipts for Dunki: Shah Rukh Khan flick surpasses 157 crore.

The most recent film from Red Chillies Entertainment, Dunki, starring Vicky Kaushal, Shah Rukh Khan, and Taapsee Pannu and directed by Rajkumar...

-

235Movie

235MovieDunki Movie Review : Shah Rukh Khan’s Dunki is dunked with love and longing

In this captivating tale, we are introduced to the valiant soldier, Hardayal Singh Dhillon, portrayed by the illustrious Shah Rukh Khan. Embarking...

-

172TV News

172TV NewsTV Series “Cruel Intentions” Available on Amazon Prime Video

The highly anticipated television adaptation of “Cruel Intentions” is making its way to the esteemed platform of Amazon Prime Video. Here’s everything...

The Latest

-

Guides

GuidesShould You Side With Stone Lord Or Nine Fingers Thieves Guild In Baldur’s Gate 3

-

Guides

GuidesHow To Get Rid Of Enemy Of Justice Condition In Baldur’s Gate 3

-

Guides

GuidesHow To Play Baldur’s Gate 3 Multiplayer Co-op

-

Elden Ring

Elden RingElden Ring, Temple of Eiglay

-

News

NewsMona Singh opens out on Instagram twice in 2023, owing to photographs she took with Aryan Khan and Shah Rukh Khan.

-

Film

FilmAnimal, starring Bobby Deol and Ranbir Kapoor, is currently the fourth-highest grossing Indian movie in North America and is headed for $15 million.

-

News

NewsAfter the success of Dunki, Shah Rukh Khan meets fans outside Mannat with folded hands. Observe

-

News

NewsDay 3 global box office receipts for Dunki: Shah Rukh Khan flick surpasses 157 crore.

-

Movie

MovieDunki Movie Review : Shah Rukh Khan’s Dunki is dunked with love and longing

-

TV News

TV NewsTV Series “Cruel Intentions” Available on Amazon Prime Video